The UCOVI Blog

The UCOVI Blog

The Power BI End Game: Part 3 – Cornering the BI market

Ned Stratton: 21st September 2020

So far I have explored the evolution of Power BI as a software tool since 2015, and what it reveals about both how Microsoft imagines the suite of data-facing roles in the modern business to be (Part 1), and what its strategy is for providing the necessary technology to those who perform these roles (Part 2).

But with $143 billion revenue and 150,000 staff, Microsoft has bigger fish to fry than catering to Insight Explorers called Vic and weaning us off SSRS reports.

"Our mission is to empower every person and every organisation on the planet to achieve more" is the strapline on its About page. For this, read "Our mission is to sell technology products to every person and every organisation on the planet that wants to achieve more".

So what constitutes 'achieving more' with technology for a business in 2020?

The answer, as has become trite to state nowadays, is being data-driven.

Savvy companies spot data points scattered everywhere in their organisation. Customers and customer actions, accounts, IT system logs, email traffic, even internal project tracking documents all have data that can be structured and blended into a central and complete repository for reports and analytics. This is the essence of business intelligence.

Against fierce competition, Microsoft is big in the market for the affection and loyalty of such companies. Strategic aim #3 – the last and most significant - of the Power BI end game trilogy is to corner the business intelligence market.

The competition and the rivals

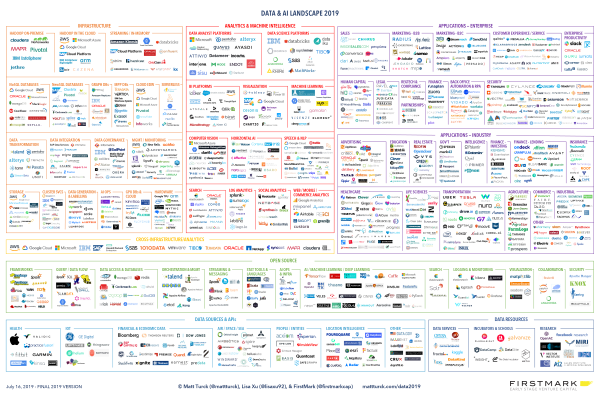

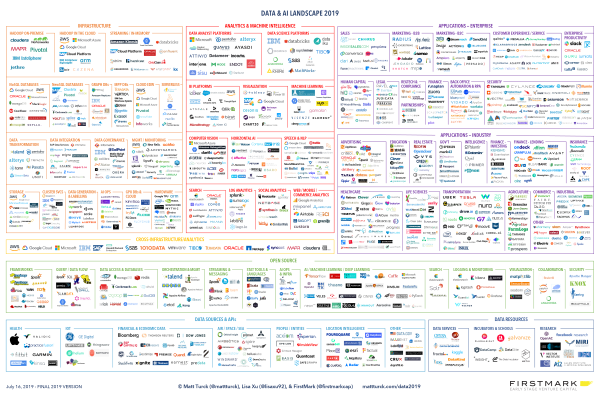

The easy way to highlight the saturation of the IT and data services market would be to lay out the latest Big Data Landscape (see 2019 image below) and leave it there. But I feel this slightly misses the point as many of the companies on this landscape occupy comparatively small market share and are likely to be taken over by one another. Furthermore, Big Data landscapes tend to miss off other important business technology groups that, while not being primarily for data analysis or management, nonetheless generate data that plays an important part in the BI piece - the HR logs, email traffic and internal project tools mentioned earlier.

A better way to see Microsoft against its business intelligence supply competitors is to frame it as an Olympic heptathlon, unpicking each data/IT discipline as one of the 7 events, and picking out the product that would represent the athlete in 'Team Microsoft', as well as its main rival in that event.

| The BI Heptathlon | ||

| Event | Team Microsoft | Closest Rival(s) |

| Infrastructure and Data Storage | Azure | Amazon Web Services |

| ETL | Power BI (Power Query/Dataflows) | Alteryx |

| Analytics and Visualisation | Power BI | Tableau |

| CRM (Customer Relationship management) | Dynamics 365 | Salesforce |

| Accounting | Dynamics 365 | Sage |

| Emailing | Outlook | Gmail |

| Project and Team Management | Excel/Microsoft Project | JIRA/Monday.com |

To Microsoft or not to Microsoft – that is the question

Looking at the events on their own, I'd say that Azure and Amazon are neck-and-neck in Infrastructure, as are Dynamics and Salesforce in CRM and Power BI/Tableau in Visualisation, with Power BI just shading it. In ETL, Alteryx is ahead but Power BI Dataflows could overtake it, and Sage probably overpowers Dynamics in Accounting. Outlook wins Emailing hands down- its closest rival Gmail has only been used in 1 of the 5 companies I've worked for and I suspect that reflects the wider trend. Lastly, in Project and Team Management JIRA has 4 times more clout than Microsoft Project if Google Trends is anything to go by, and Monday.com should start eating into this market after spending $12 million relentlessly annoying the whole of Youtube in 6-second bursts before the Skip Ad button. I added Excel into this event as a support runner for Microsoft Project to represent the many who still like to log everything on a tracking spreadsheet and make their own Gantt charts. But I'd call this one against Microsoft on the grounds of JIRA's prominence.

So 2 wins for Microsoft, 2 dead heats, and 3 wins for the various companies competing against them.

However, – and this is what the unhelpful visual joke of the Big Data Landscape hides – describing the competition as "various companies" isn't altogether accurate. Observant blog readers will see that Alteryx, Sage, Sales Force and Tableau are highlighted. This is because they're actually one big team of their own. Sage has been in strategic partnership with Salesforce since May 2015. Salesforce bought Tableau in 2019, "bringing together the world's #1 CRM with the #1 analytics platform", in the words of SalesForce Chairman Marc Benioff. Tableau, meanwhile, is promoted as the Featured Technology Partner of Alteryx, and Tableau + Alteryx is very much a thing with many a consultant out there specialising in the implementation of both in tandem.

This under-the-radar four-way partnership threatens to pose a credible, joined-up alternative to Microsoft for any business that wants to harmonise their core customer data with their financial, combine disparate other important data assets or pipelines, merge it all together into a common data model and then make dashboards from it.

Add in the infrastructure solution, and integration for a high-profile ESP and project management tool, and this grouping could claim to offer the complete holy grail of business intelligence; a single source of truth with which to quantify customer engagement, business growth, financial health, and importantly staff productivity and project success/failure. The latter two have traditionally been measured qualitatively but project data analytics is a field which is steadily gaining traction and interest.

In this arrangement, Alteryx is the partner that integrates Sage finance and Salesforce customer datasets, then processes it and feeds it to Tableau, which is what the business interacts with.

This is why Power BI is so important on the Microsoft side. Power BI – encompassing Desktop, the service, Power Query and Dataflows – does the job of Tableau and Alteryx at once. Not only that, it links up the rest of Microsoft’s answers to the data you need for complete BI – Dynamics for your customer and finance data, Microsoft Exchange data for your emails, calendars and Active Directory, and Microsoft Project data – in an integrated way that is easy to manage permissions-wise at an organisational level within the framework of Office 365. All of these tools have the Microsoft branding and application design, which gives business users a sub-conscious but valuable reassurance of connectedness across its technology applications.

And since Power BI connects to and easily tabulates data from Microsoft Exchange and Project, this enables a company to crunch the numbers on qualitative yet actually very important efficiency drivers, such as how long projects are really taking against expectation and how much time their staff are spending in meetings and responding to emails. The Sage/Salesforce/Tableau/Alteryx quad lack all this to date, having continued to brand themselves separately and not enlisted a data infrastructure or project/communication tool partner.

Microsoft may not win at all the individual events that make up the business intelligence heptathlon, but they are the only athlete that can do the whole heptathlon without breaks, and wearing the same tracksuit the whole way through so that the crowd know who to cheer for.

Power BI's main purpose, and what steers its development priorities toward ETL and self-service analytics capability away from filling small gaps in its visual tools, is ultimately to be the sun around which orbits the solar system of an end-to-end Microsoft solution to BI and analytics for all elements of a business.

For the data-driven business, the BI technology adoption decision thus changes from a crowded pick and mix of companies and products flouting hubristic performance claims into a simple, binary choice: Microsoft or not Microsoft. The Power BI evolution journey shows how much they want to double down on this if their competitors continue to join forces.

⌚ Back to Latest Post